cryptoairdrops.ru Overview

Overview

A Last Will

Contents A living will outlines a person's medical wishes in case they become incapacitated, while a last will and testament dictates the distribution of a. A Last Will generally spells out how you want your estate distributed upon your death. Your will can establish conditions for the distribution of your estate. Our interactive online will maker. Enter your information and create a last will and testament customized to your wishes. We've broken down the basics of creating your will; helping you understand what it contains and why it's so important to have. Why Should I Make a Texas Will? A will, also called a "last will and testament," can help you protect your family and your property. You can use a will to. What is a Last Will and Testament? · 1. Who will serve as the personal representative/executor · 2. What powers your personal representative/executor will have. A last will and testament allows you to decide how you want your property to be distributed among family, friends or charities. LegalZoom can help you start. Though it has been thought a "will" historically applied only to real property, while "testament" applied only to personal property (thus giving rise to the. A Will, also known as a Last Will and Testament, is a legally prepared and bound document that states your intentions for the distribution of your assets and. Contents A living will outlines a person's medical wishes in case they become incapacitated, while a last will and testament dictates the distribution of a. A Last Will generally spells out how you want your estate distributed upon your death. Your will can establish conditions for the distribution of your estate. Our interactive online will maker. Enter your information and create a last will and testament customized to your wishes. We've broken down the basics of creating your will; helping you understand what it contains and why it's so important to have. Why Should I Make a Texas Will? A will, also called a "last will and testament," can help you protect your family and your property. You can use a will to. What is a Last Will and Testament? · 1. Who will serve as the personal representative/executor · 2. What powers your personal representative/executor will have. A last will and testament allows you to decide how you want your property to be distributed among family, friends or charities. LegalZoom can help you start. Though it has been thought a "will" historically applied only to real property, while "testament" applied only to personal property (thus giving rise to the. A Will, also known as a Last Will and Testament, is a legally prepared and bound document that states your intentions for the distribution of your assets and.

A Last Will and Testament is your personal instruction manual about what is to happen to you, your remains and your possessions after you die. I hereby declare that this is my last will and testament and that I hereby revoke, cancel and annul all wills and codicils previously made by me either. If you care about who inherits your property, an estate plan should be a part of your last will and testament, contact California lawyer Robert L. Cohen. A will allows you to exercise control over the disposition of your property. Any person over the age of 18 who is of “sound mind” can make a will at any time. A Last Will and Testament is a legal document that outlines your last wishes. Make yours for free and save, print & download. A Last Will and Testament in TX lists a person's wishes following their death. It states how property is disposed, names an executor, guardian and/or. A Last Will and Testament is a legal document that details your wishes on what will happen with your property, assets, and dependents upon your death. It also. A last will and testament is a legal document that specifies how you want your assets to be distributed after your death. It also allows you to name an executor. A will provides for the distribution of certain property owned by you at the time of your death, and generally you may dispose of such property in any manner. A last will and testament or will is a legal document outlining how an individual (testator) wants to transfer their assets after death. A Last Will and Testament is a legally binding document that allows you to designate how your property will be distributed upon your death, who will serve as. When it comes to estate planning, many people wonder if they can simply write their wishes down in an email and have it be considered a legal Last Will and. When a will only deals with real property, it may be called a devise, and when a will only deals with personal property, it may be called a testament. If a. In North Carolina, a will does not expire during the lifetime of the person who drafted it. It remains valid until it is revoked, revised, or executed. These witnesses should not be beneficiaries. Write a Will. Start your legal document by using the title “Last Will and Testament” and including personally. A Last Will and Testament is the legal document which controls the disposition of your property at death and may provide for guardianship for your children. A Will, or a last Will and Testament, is a legal document that describes how you would like your property and other assets to be distributed after your. cryptoairdrops.ru: Last Will & Testament Forms - USA - Do-it-yourself Legal Forms by Permacharts: Office Products. A last will and testament is a legal document that outlines a person's instructions on their specific property and communicates their final wishes to.

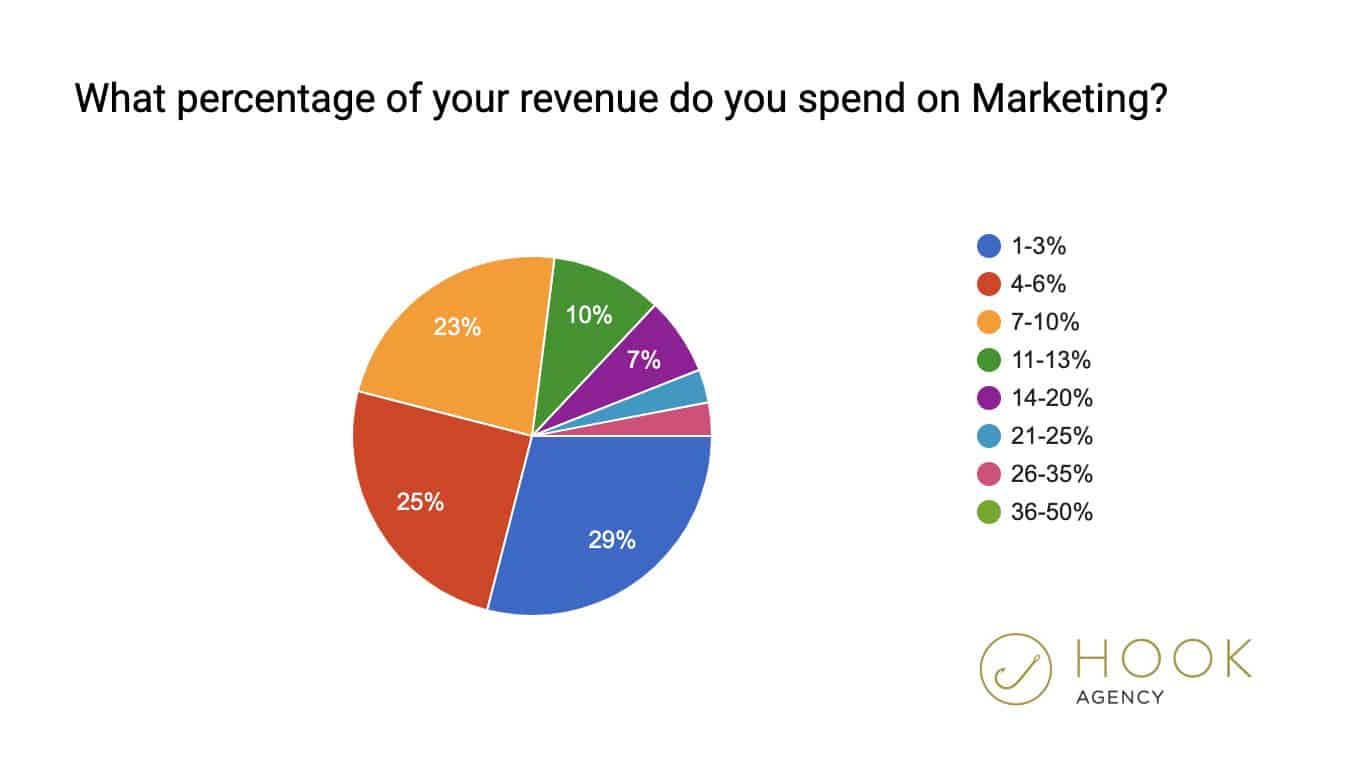

Marketing As A Percentage Of Revenue

However, the U.S. Small Business Association recommends that you should only utilize a percentage of your revenue for marketing if your margins fall at or above. You can calculate cost of marketing as a percentage of revenue—between 7% and 20% of revenue, including labor costs. A marketing budget typically range from 5 to 25 percent of a company's revenue or revenue targets, depending on company size, stage of growth, and the. Best practice suggests budgeting for marketing as a percentage of revenue target. Gartner research reports that marketing budgets have dipped to a post-pandemic. Every company is different — every marketing budget should be different too! When calculating a marketing budget as a percentage of revenue, the typical. Marketing budgets decline as a percent of total revenue from to Download Marketing Budget Benchmarks. See how your spend decisions compare to. This measure calculates the budget for marketing as a percentage of revenue for the reporting period. The budget for marketing is the amount an organization. This metric shows the percentage of revenue that is spent on Sales & Marketing during a given time period. A common rule of thumb is that B2B companies should spend between 2 and 5% of their revenue on marketing. For B2C companies, the proportion is often higher—. However, the U.S. Small Business Association recommends that you should only utilize a percentage of your revenue for marketing if your margins fall at or above. You can calculate cost of marketing as a percentage of revenue—between 7% and 20% of revenue, including labor costs. A marketing budget typically range from 5 to 25 percent of a company's revenue or revenue targets, depending on company size, stage of growth, and the. Best practice suggests budgeting for marketing as a percentage of revenue target. Gartner research reports that marketing budgets have dipped to a post-pandemic. Every company is different — every marketing budget should be different too! When calculating a marketing budget as a percentage of revenue, the typical. Marketing budgets decline as a percent of total revenue from to Download Marketing Budget Benchmarks. See how your spend decisions compare to. This measure calculates the budget for marketing as a percentage of revenue for the reporting period. The budget for marketing is the amount an organization. This metric shows the percentage of revenue that is spent on Sales & Marketing during a given time period. A common rule of thumb is that B2B companies should spend between 2 and 5% of their revenue on marketing. For B2C companies, the proportion is often higher—.

- For both B2B product and services companies, % of their overall budget is for marketing. Marketing Budgets as a Percentage of Overall Budget and Revenue. 1. Tally the total financial cost of your investment in your marketing efforts. 2. Calculate the gross profit you made on the marketed product or service. This is the most common method, where a fixed percentage of the business's total revenue is allocated to marketing. This percentage typically ranges from 5% to. Marketing budgets have increased to percent of overall company revenue in , up from percent in , according to Gartner. Businesses typically average between 6%% of their revenue, though some swear by the 5% rule (more on this in a minute). Some companies may be highly profitable with a marketing budget set at a fraction of one percent, whereas others might need to spend a quarter of their revenue. Short answer: There's no magic percentage to your question. I'd spend more time being thoughtful about the type of marketing activities you think would be. Do you budget your marketing efforts based on percentages, number of people through the door, or another metric? Does your budget fluctuate. Many small businesses aim to spend 2% to 5% of their total revenue on marketing. However, it depends on how much you're willing to spend. You should spend around 5% of your total revenue. If you want to grow (as most businesses do), the general rule of thumb is to spend around 10%. A typical range for sales and marketing expenses as a percentage of revenue in the SaaS industry is generally between 30% and 60%. The median sales and. This measure calculates the combined budgets for sales and marketing (including trade spending, if applicable) as a percentage of revenue for the reporting. Many strategists will throw general numbers out ranging from 7% to 12% of an organization's revenue but there are so many variables that should be considered. When considering solely the business-to-business market, companies in B2B Products spent on average % of revenues on marketing and B2B Services spent on. When looking at the marketing budget percentage model, % is a safe chunk of your overall revenue that'll steadily improve your company's customer base. It's. For B2B products, total marketing spending averages % of revenue. For B2B services, total marketing spending averages % of revenue. Revenue-based. One way to determine your marketing budget is to review your annual revenue sheets and set aside a percentage. Some businesses might allocate. According to various industry reports and experts, most companies allocate between 5% to 10% of their revenue to marketing. Ten percent. This is the portion of revenue that businesses are told to invest in their annual marketing budget. But is this really true? How can we compare.

Capital Gain Tax In America

A flat tax of 30 percent (or lower treaty) rate is imposed on US source capital gains in the hands of nonresident individuals present in the United States for. Capital gains are included as part of income and taxed at the individual's marginal/graduated tax rate for residents (highest of 35%) and 25% for non-residents;. Capital gains are included as part of income and taxed at the individual's marginal/graduated tax rate for residents (highest of 35%) and 25% for non-residents;. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. A capital gain occurs when you sell an asset for a price higher than its basis. · If you hold an investment for more than a year before selling, your profit is. States with no capital gains tax. A little more than a handful of states have no capital gains tax. Those include Alaska, Florida, New Hampshire, Nevada, South. This capital gain is taxed differently depending on how long you held the capital asset for. If you didn't hold it for a while, your gain may be taxed upwards. Different tax rates apply for long- and short-term capital gains. As of February 11, , the tax rate on most net capital gain is 15% for most individuals. While the standard long-term capital gains tax rates apply to most assets, there are a few exceptions. First, and perhaps most relevant for most Americans, is. A flat tax of 30 percent (or lower treaty) rate is imposed on US source capital gains in the hands of nonresident individuals present in the United States for. Capital gains are included as part of income and taxed at the individual's marginal/graduated tax rate for residents (highest of 35%) and 25% for non-residents;. Capital gains are included as part of income and taxed at the individual's marginal/graduated tax rate for residents (highest of 35%) and 25% for non-residents;. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. A capital gain occurs when you sell an asset for a price higher than its basis. · If you hold an investment for more than a year before selling, your profit is. States with no capital gains tax. A little more than a handful of states have no capital gains tax. Those include Alaska, Florida, New Hampshire, Nevada, South. This capital gain is taxed differently depending on how long you held the capital asset for. If you didn't hold it for a while, your gain may be taxed upwards. Different tax rates apply for long- and short-term capital gains. As of February 11, , the tax rate on most net capital gain is 15% for most individuals. While the standard long-term capital gains tax rates apply to most assets, there are a few exceptions. First, and perhaps most relevant for most Americans, is.

For tax year , the 28% tax rate applies to taxpayers with taxable incomes above USD , (USD , for married individuals filing separately). For tax. Your profit when you sell a stock, house or other capital asset. If you owned the asset for more than a year, the gain is considered long-term, and special tax. Your profit when you sell a stock, house or other capital asset. If you owned the asset for more than a year, the gain is considered long-term, and special tax. Where you have realized capital gains, the capital gain tax rate you pay depends on whether the gain is long-term or short-term, as well as on your income level. Capital gains are generally included in taxable income, but in most cases, are taxed at a lower rate. A capital gain is realized when a capital asset is sold or. No tax on the $ capital gain is ever paid. If you eventually sell the asset for $, you would have a basis of $ and hence pay tax on capital gains of. An easy and impactful way to reduce your capital gains taxes is to use tax-advantaged accounts. Retirement accounts such as (k) plans, and individual. The federal income tax does not tax all capital gains. Rather, gains are taxed in the year an asset is sold, regardless of when the gains accrued. Unrealized. The three levels for long-term capital gains taxes are 0, 15, and 20 percent. Some special tax treatments exist for specific stocks, collections, and real. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. Non-resident aliens are taxed at 30%, collected by withholding at the source of the payment, on US-source net capital gains if they are in the United States for. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing status. The maximum capital gains tax rate for individuals and corporations · – · % · %. Some states also levy taxes on capital gains. Most states tax capital gains according to the same tax rates they use for regular income. So, if you're lucky. They are not taxed as ordinary income for a number of reasons. First, all the money used for capital investments has already been taxed. So. They are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming. Note: The states of Arizona, Arkansas, Hawaii, Montana, New Mexico. The capital gain will generally be taxed at 0%, 15%, or 20%, plus the % surtax for people with higher incomes. However, a special rule applies to gain on the. In the United States, individuals and corporations pay a tax on the net total of all their capital gains. According to the Urban Institute, capital gains were taxed at the same rates as regular income from to Since then, capital gains have been taxed at. Economic theory tells us that when the cost of funds goes down, firms will use the opportunity to borrow more funds so that they can increase their investment.

Free Expense Budget Template

Free excel budgeting templates for · 1. Expense tracker by Sheetgo · 2. Monthly Budget Planner by Money Under 30 · 3. Annual Budget Planner by Budget. By visualizing your income and expenses in an organized manner, you gain valuable insights into your spending patterns and can make informed decisions about. Download free project budget templates in a variety of formats, and learn about the importance of project budgeting. This Excel budget template contains commonly used expense types and automatically calculates fringe and overhead rates. It is formulated for Modified Total. Try our free Operating Budget Template today. Plan operating expenses by category and use our dashboard to compare expenses across years. Download free budget template now and print it at office or at home. Monthly Budget and Expense Tracker Template. Download & print. Minimal Monthly. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. 6 Free Budget Template Spreadsheets · Best yearly budget template: Vertex42 · Best monthly budget template: Vertex42 · Best weekly budget template. Save time and money with these personal budgeting templates. Discover monthly budget templates, vacation budget templates, and more that you can customize. Free excel budgeting templates for · 1. Expense tracker by Sheetgo · 2. Monthly Budget Planner by Money Under 30 · 3. Annual Budget Planner by Budget. By visualizing your income and expenses in an organized manner, you gain valuable insights into your spending patterns and can make informed decisions about. Download free project budget templates in a variety of formats, and learn about the importance of project budgeting. This Excel budget template contains commonly used expense types and automatically calculates fringe and overhead rates. It is formulated for Modified Total. Try our free Operating Budget Template today. Plan operating expenses by category and use our dashboard to compare expenses across years. Download free budget template now and print it at office or at home. Monthly Budget and Expense Tracker Template. Download & print. Minimal Monthly. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. 6 Free Budget Template Spreadsheets · Best yearly budget template: Vertex42 · Best monthly budget template: Vertex42 · Best weekly budget template. Save time and money with these personal budgeting templates. Discover monthly budget templates, vacation budget templates, and more that you can customize.

Explore professionally designed budget templates you can customize and share easily from Canva.

Create Your Budget. A, B, C, D, E, F, G. 1. 2, MONTHLY BUDGET WORKSHEET. 3, Enter your monthly income (Incoming Money), expenses (Outgoing Money) and savings . If you have an expense that does not occur every month, put it in the “Other expenses this month” category. MONTH. YEAR. My income this month. Income. Monthly. How to make a budget plan - use free tools and templates to manage your money. Get free expert advice from StepChange, the leading UK debt charity. Our free online budget planner helps you track, plan and prioritise where your money is going. Download free Excel Budget Templates for creating family, personal, business, and household budgets. Simply list all your income sources and their amounts in the Income table, and track your spending in the Expenses table. Top 10 Free Budget Templates. Stay on top of your income and expenses with this monthly budget template, designed to help you keep track of where your money is going. Your savings plan. Create Your Budget. A, B, C, D, E, F, G. 1. 2, MONTHLY BUDGET WORKSHEET. 3, Enter your monthly income (Incoming Money), expenses (Outgoing Money) and savings . Personal Budget Worksheet. A, B, C. 1, PERSONAL BUDGET WORKSHEET. 2, (Spending Plan). 3, MONTH: 4, INCOME: Budget, Actual. 5, Salary. 6, Partner's Salary. 7. Easy to use with more personalized expense categories than other similar templates. Compare your spending to budgeting guidelines. What Does a Normal Personal. This template gives you a close look at your household's planned versus actual income and details expenses for individual categories on a monthly basis. PERSONAL MONTHLY BUDGET TEMPLATE. 14 votes, comments. I'd like to know if there's a personal budget template for excel that is similar to the Ultimate Personal Budget. Take charge of your finances with Clockify's free budgeting templates. Plan your expenses, stay on top of your income, and reach your financial goals. If you have access to a Google account, Google Sheets has monthly and yearly budget templates for free. Manage your finances with Notion's Budgets templates. Track expenses, plan budgets, and set financial goals. · Related Collections · Top 10 Free Budget Tracker. Free Budget Templates. Download spreadsheets for creating personal, family expenses and create your college budget plan. Related Templates. Expense Tracking Template · File cryptoairdrops.ru · You can add expenses that are categorized by suppliers and categories in this template. The template will. Budget Planner on the go! Your Ultimate Monthly Budget Planner and Daily Expense Tracker! Are you tired of financial stress and complex money management. Creating a convenient and flexible Expense Budget Template from scratch is a task for a pro. Start using our Geometric Personal Budget Template for free today.

Atm Service Charge

If you use a vendor to rebate fees charged to your members for using your own credit union ATMs, you can also offer them a rebate using a CU*BASE service charge. *Fees may be charged by the company that owns the ATM (called a surcharge). If there is a surcharge, the fee amount will be displayed on the ATM screen, and you. Two types of consumer charges exist: the surcharge and the foreign fee. The surcharge fee may be imposed by the ATM owner (the bank or Independent ATM deployer). Avoid a Maintenance Service Charge: Do one of the following during each statement period. Overdraft charges will not be imposed on ATM withdrawals or. ATM Cards & Debit Cards · $2 For Each Transaction at Foreign Terminals · $5 For Each Card Reissue · $ ATM Withdrawal Daily Limit · $3, Point-of-Sale Daily. Domestic ATM ; Free · From yen to yen, depending on the time period. The fee is also sometimes referred to as a monthly service charge and is automatically withdrawn from your account. Banks usually don't charge ATM fees. 2. Understand the types of fees being charged. The non-Bank of America ATM usage fee is $5. This fee is assessed for each withdrawal or transfer performed at a. An ATM surcharge fee is the fee an owner of an ATM charges cardholders from other financial institutions who use their machine. In other words, if you have an. If you use a vendor to rebate fees charged to your members for using your own credit union ATMs, you can also offer them a rebate using a CU*BASE service charge. *Fees may be charged by the company that owns the ATM (called a surcharge). If there is a surcharge, the fee amount will be displayed on the ATM screen, and you. Two types of consumer charges exist: the surcharge and the foreign fee. The surcharge fee may be imposed by the ATM owner (the bank or Independent ATM deployer). Avoid a Maintenance Service Charge: Do one of the following during each statement period. Overdraft charges will not be imposed on ATM withdrawals or. ATM Cards & Debit Cards · $2 For Each Transaction at Foreign Terminals · $5 For Each Card Reissue · $ ATM Withdrawal Daily Limit · $3, Point-of-Sale Daily. Domestic ATM ; Free · From yen to yen, depending on the time period. The fee is also sometimes referred to as a monthly service charge and is automatically withdrawn from your account. Banks usually don't charge ATM fees. 2. Understand the types of fees being charged. The non-Bank of America ATM usage fee is $5. This fee is assessed for each withdrawal or transfer performed at a. An ATM surcharge fee is the fee an owner of an ATM charges cardholders from other financial institutions who use their machine. In other words, if you have an.

The ATM fees vary widely by bank, but most range between $2 and $3 per transaction. Some banks also charge monthly fees for using additional services like. ATMS ; Non-Provident ATMS01 (first 4 transactions). No Fees ; Withdrawal Service Charge02 (each). $ ; Business Accounts - Withdrawal service charge (each). The non-Wells Fargo ATM operator or network may also charge a fee. ATM Cash Debit Card Overdraft Service: No overdraft fee will be assessed on ATM. This resolution opposes government imposed caps or elimination of ATM service charges. ATMs are widely used machines that many consumers rely upon to. According to Bankrate, out-of-network ATM operators charge customers an average fee of $ For this service, banks typically charge between $16 to $35 for. Not if it's a Regions ATM. If you're using a non-Regions ATM, the charge is $3 per withdrawal in addition to any fees assessed by the owner/operator of the. An ATM transaction fee is a charge imposed by banks or financial institutions to cardholders for ATM services. These fees are not fixed and can vary from bank. Excess of three checks per month – $5 each. ATM / Debit Cards. FEE. NOTES. ATM Withdrawal Service Charge ATM Inquiry Service Charge. $0. Other financial. ATM transactions cost about Rs/- per transaction in India on average including rent, power, inter-bank transfer charges and maintenance. When you use an ATM independently owned or operated by another bank, your bank will often charge an out-of-network fee and the ATM owner will add a surcharge. Automated teller machines, or ATMs, are for accessing cash and conducting banking transactions for products and services that require cash. · If you are charged. The network keeps part of the interchange fee as a "switch fee" to cover its costs. Interchange fees, which typically range from 50 cents to $2, are usually. MoneyPass offers a surcharge-free ATM experience for qualified cardholders at a variety of convenient locations throughout the United States. You can avoid the monthly service fee with one of the following each fee period: ATM fees per transaction – At non-Wells Fargo ATMs. (non-Wells Fargo ATM. Maintenance Service Charge. Maintenance Service Charge. No fee. Monthly Maintenance Service Charge. ATM Transactions. KeyBank ATMs. No fee. Avoid ATM surcharge. ATM Transaction Fee Spring Bank, Citi Bank branch ATM and MoneyPass network $10 (Waive monthly service charge with $2, monthly average balance, or with. ACH Batch Charge $ **Overdraft fee applies to overdrafts created by check, in-person withdrawal or other withdrawals by electronic means which are not ATM. This fee is debited from the account at the end of the month. Banks also charge service charges for using the ATM of a competing bank, or when initiating a wire. Charge for Debit Foreign Transaction Fees. The fees are often 1% to 3% of the amount of a purchase or ATM withdrawal. Updated Mar 14, · 1 min read.

Pros And Cons Of Collecting Social Security Early

Anyone eligible to collect Social Security benefits can choose to receive them at full retirement age or as early as 62 years old. Many people retire early. Learn more at cryptoairdrops.ru Taking Benefits Early vs. Late. Delaying benefits past your full retirement age may make sense if you. Crystal Edwards: The advantage of taking retirement benefits early is that you start to collect the money that you've been paying over to the government monthly. The voluntary suspension rule. If you started collecting reduced benefits before your full retirement age (FRA) and missed the reset deadline, you can suspend. Disadvantages of Taking Social Security Early · 1. Your Benefits Are Permanently Reduced · 2. Your Cost-of-Living Adjustments Will Be Smaller · 3. You'll Be. The most obvious benefit of withdrawing your Social Security early is that you get your money the fastest. If you begin taking out money at age 62, you'll be. By taking your Social Security benefit early you will receive a smaller monthly benefit than waiting until your full retirement age. You will also get less from. While you're entitled to begin collecting Social Security income at age 62, this is considered early filing. There are valid reasons for filing early, but. Taking Social Security early reduces your benefits, but you'll also receive monthly payments for a longer period of time. On the other hand, taking Social. Anyone eligible to collect Social Security benefits can choose to receive them at full retirement age or as early as 62 years old. Many people retire early. Learn more at cryptoairdrops.ru Taking Benefits Early vs. Late. Delaying benefits past your full retirement age may make sense if you. Crystal Edwards: The advantage of taking retirement benefits early is that you start to collect the money that you've been paying over to the government monthly. The voluntary suspension rule. If you started collecting reduced benefits before your full retirement age (FRA) and missed the reset deadline, you can suspend. Disadvantages of Taking Social Security Early · 1. Your Benefits Are Permanently Reduced · 2. Your Cost-of-Living Adjustments Will Be Smaller · 3. You'll Be. The most obvious benefit of withdrawing your Social Security early is that you get your money the fastest. If you begin taking out money at age 62, you'll be. By taking your Social Security benefit early you will receive a smaller monthly benefit than waiting until your full retirement age. You will also get less from. While you're entitled to begin collecting Social Security income at age 62, this is considered early filing. There are valid reasons for filing early, but. Taking Social Security early reduces your benefits, but you'll also receive monthly payments for a longer period of time. On the other hand, taking Social.

You can apply for early Social Security retirement benefits beginning at age However, taking retirement early reduces the amount of your benefit for the. Social Security begins at age 62, subject to an earnings limitation. Effect of Early Retirement on Benefits. Health Benefits: Employees retiring in. But Social Security experts advise waiting as long as possible to start collecting benefits, up to age This is because if you delay taking retirement beyond. Depending on what someone's retirement age is, the decision to collect Social Security early could result in a monthly reduction of about 20 to 30 percent of. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. If you start taking Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. Social Security Disability could pay you full benefits. If you have worked long enough, and paid enough Social Security taxes on your earnings, you are covered. SSA logo: link to Social Security Online home. Effect of Early or Delayed Retirement on Retirement Benefits. Benefit, as a percentage of Primary Insurance. Step 1: Explore how the age you start collecting Social Security affects your retirement benefits early 60s until you reach your full Social Security benefit. collecting Social Security affects your retirement benefits. Enter your early 60s until you reach your full Social Security benefit claiming age. If. The benefit of taking Social Security retirement benefits early (at age 62) is simple: You will receive benefits over a longer period of time. Every year you delay claiming those benefits (up to age 70) means potentially bigger monthly checks once you do start. And higher monthly benefits over your. The wisdom of collecting Social Security early also depends on the type of work you do. Retiring early from a backbreaking assembly line position, for. Early career. Toggle Otherwise, you will have to repay any excess Social Security benefits you receive once you begin receiving your CalSTRS benefit. At age 80, $2, for men and $1, for women. The easiest, most accurate way to estimate your Social Security benefits is to create an account through the. Con: Leaving Social Security money on the table You worked hard for your Social Security benefits, but the earlier you retire, you may receive a smaller. Waiting to claim your Social Security benefit will result in a higher monthly benefit. For every year you delay past your FRA, you get an 8% increase in your. The Social Security Amendments of had provided benefits for women as early as age receiving benefits longer. Due to these problems, it soon. Social Security Disability could pay you full benefits. · Early Retirement reduces your income for the rest of your life! · Don't make the wrong decision. · Is. It's an easier choice when married for the higher earner to wait since the survivor gets the benefits of the delay no matter who dies first. If.